Building Financial Partnerships That Matter

We've spent years working with financial institutions, advisory firms, and technology companies. What we've learned? Real partnerships aren't about contracts—they're about shared goals and honest collaboration.

Our approach to partnerships centers on mutual growth. We don't just offer integration options or white-label solutions. We work with organizations who see net worth calculation as something more than a feature—it's a foundation for meaningful client relationships.

How We Actually Work With Partners

Most partnership programs follow a template. Ours doesn't. We've found that the best collaborations happen when we adapt to how your organization actually operates—not the other way around.

Our technical team has integrated with everything from legacy banking systems to modern fintech APIs. But the technology part? That's usually the easy bit. The harder work is understanding your clients' needs and making sure our tools genuinely serve them.

What Makes Our Approach Different

- Custom integration timeline based on your existing infrastructure

- Direct access to our development team during implementation

- Ongoing consultation about feature development and user feedback

- Transparent data handling with full documentation

- Flexible deployment options that match your security requirements

Questions Organizations Ask Us

We've organized these by where you are in the decision process. Skip to what's relevant for you.

Initial Exploration

- How does integration typically work?

- What's the actual implementation timeline?

- Can you handle our data compliance requirements?

- What level of customization is possible?

- How do you handle client data privacy?

During Partnership

- Who handles technical support requests?

- How often do you release updates?

- Can we request specific features?

- What's your uptime track record?

- How do you communicate changes?

Long-Term Collaboration

- How do pricing adjustments work?

- What happens if we need to scale quickly?

- Can we participate in product development?

- How do you handle partner feedback?

- What's your approach to emerging regulations?

What We've Actually Built

These aren't case studies or marketing examples. They're real projects we've completed with partner organizations over the past few years. Names are removed for confidentiality, but the details are accurate.

Regional Credit Union Network

A mid-sized credit union network needed net worth tracking integrated into their existing online banking platform. Their challenge wasn't technical—it was regulatory. Their compliance team needed complete audit trails and data residency guarantees.

We built a custom deployment that kept all calculation processing within their existing infrastructure while providing our interface layer. Implementation took four months, including two months of compliance documentation and testing.

Independent Financial Advisory Firm

An advisory firm with 80+ advisors wanted better tools for initial client discovery. They were using spreadsheets and inconsistent processes across their team. What they really needed was standardization without rigidity.

We created a white-labeled version that matched their brand completely. Their advisors input client data during discovery meetings, and the system generates comprehensive net worth reports that become part of ongoing client files.

Personal Finance Technology Platform

A consumer fintech startup needed net worth calculation as a core feature but didn't want to build it themselves. They had aggressive launch deadlines and limited engineering resources.

We provided API access with extensive documentation and dedicated integration support. Their team handled the UI while our backend managed all calculation logic, data validation, and storage requirements.

Accounting Software Integration

An established accounting software company wanted to expand beyond business accounting into personal financial management. Their users were asking for net worth tracking that connected to their existing data.

We developed a bidirectional sync that pulls relevant data from their accounting records while maintaining separate personal financial profiles. Users see business and personal finances in one place without manual data entry.

Who You'll Actually Work With

Partnership discussions usually start with one of these three people. They're not sales representatives—they're the ones who'll be involved throughout the entire relationship.

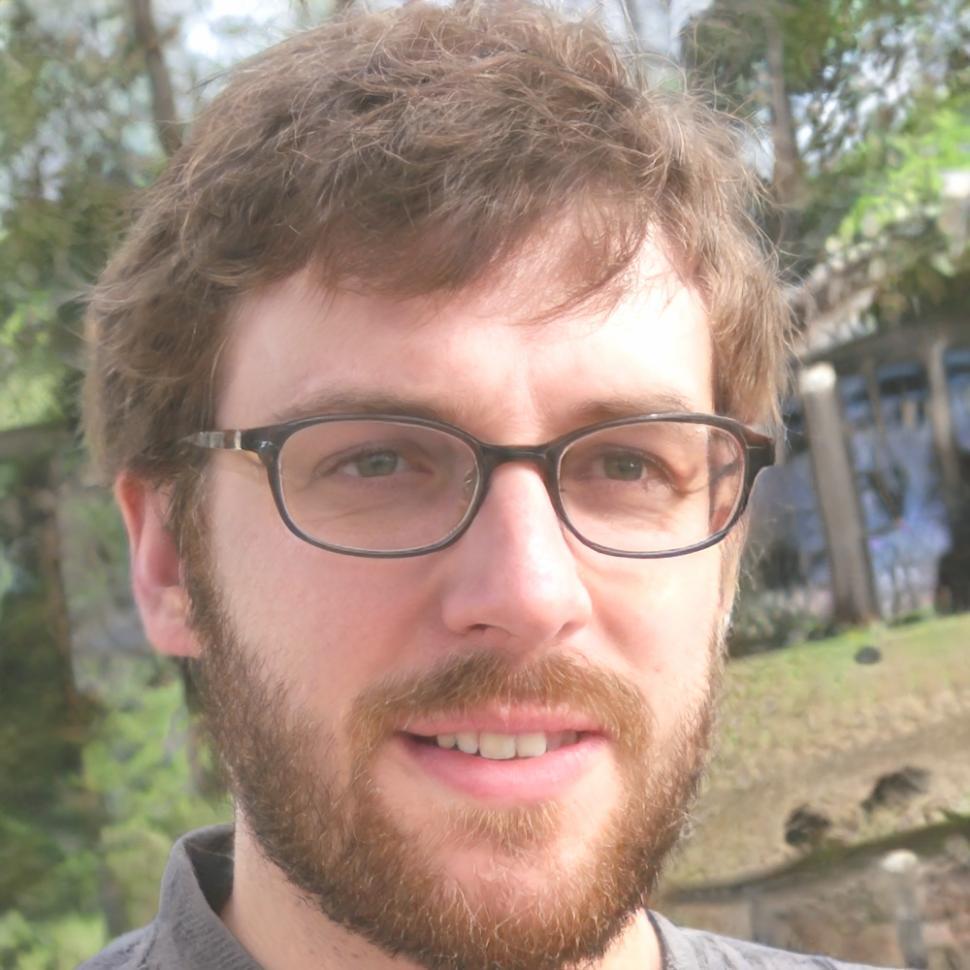

Alden Thorsby

Alden handles initial conversations and helps organizations figure out if we're a good fit. He spent eight years in financial services technology before joining us in 2023. He asks a lot of questions—mostly about what you're actually trying to accomplish rather than what features you think you need.

Brinley Waverley

Brinley manages all technical implementations. She's worked with everything from mainframe banking systems to modern cloud architectures. When partners run into technical challenges, Brinley's usually the one who finds workable solutions. She's been with miovanovasevea since we started in 2021.

Corbin Ashfield

Corbin takes over after implementation. He runs quarterly reviews, coordinates feature requests, and handles escalations when something isn't working right. His background is in client services for SaaS companies, and he joined our team in early 2024.

Let's Talk About Your Specific Situation

Partnership conversations work best when they're specific. Tell us what you're trying to accomplish, what constraints you're working within, and what timeline you're considering. We'll give you an honest assessment of whether we can help.

Start a Conversation